We find your details

Just enter your business address and we'll use industry data to accurately find and understand your energy usage.

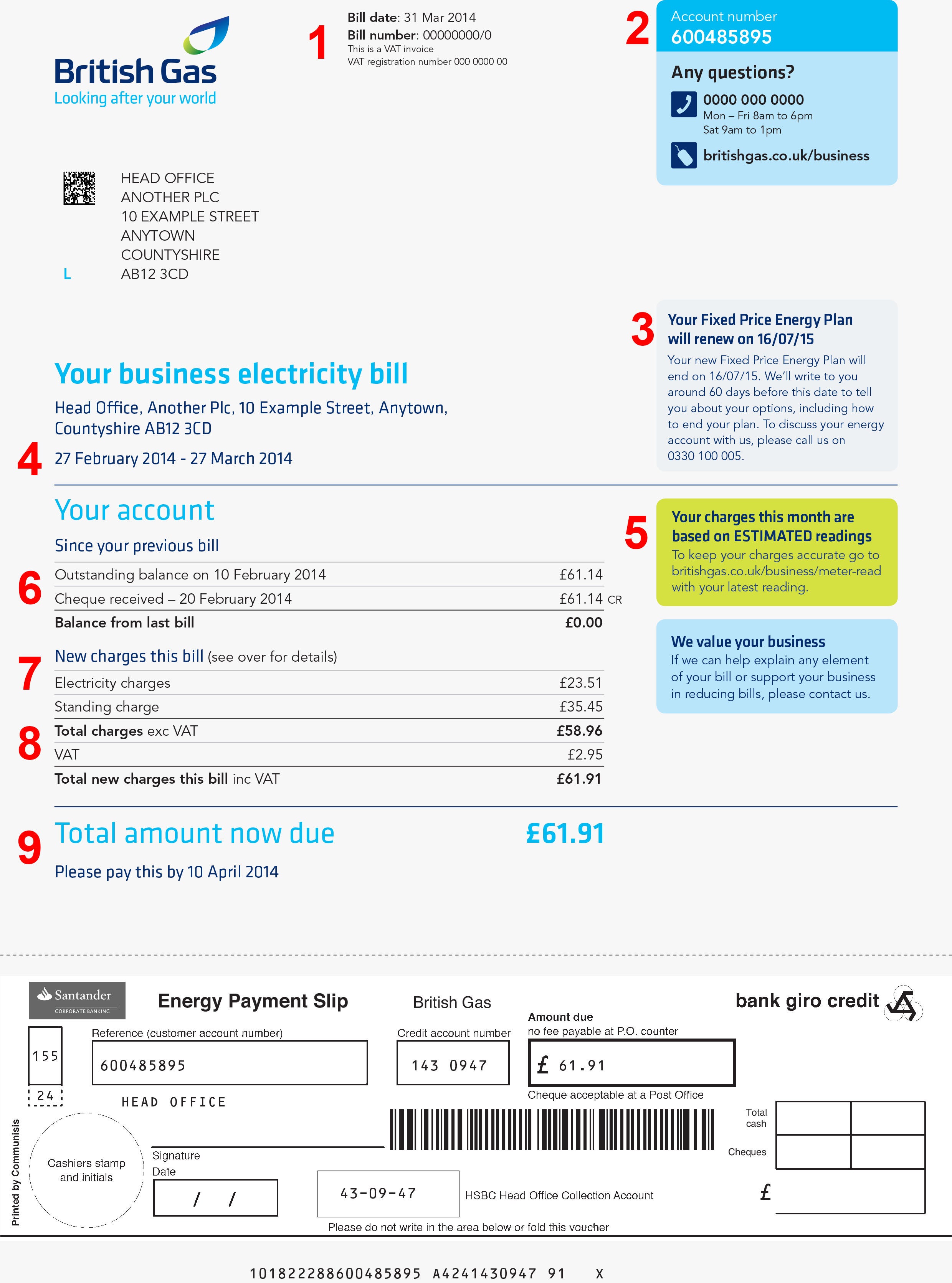

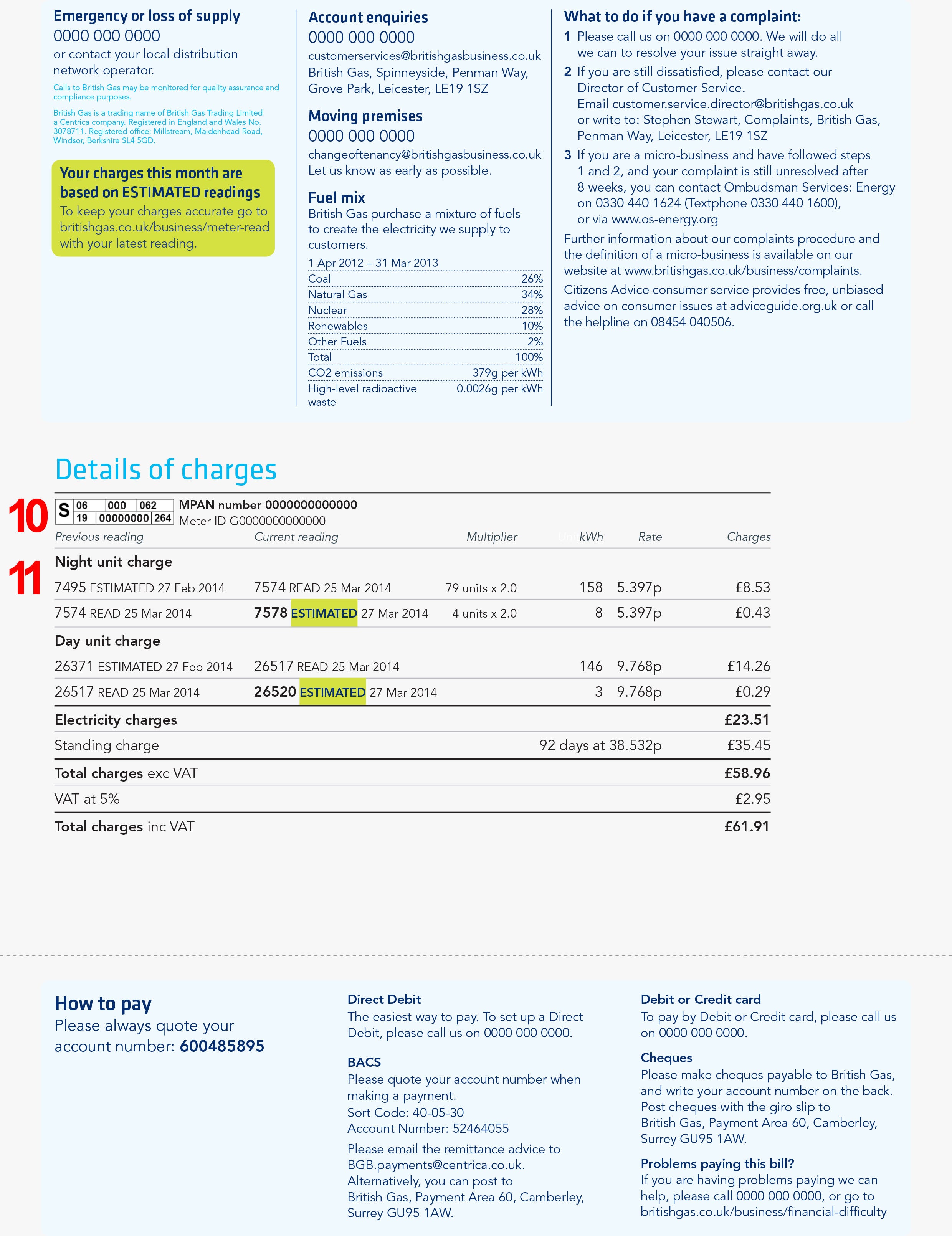

If you think your commercial gas and electricity contracts are too expensive, the first thing you need to do is take a look at your latest business energy bill. This will tell you what type of tariff you’re on and give you the info you need to check whether you're being accurately billed. There's also loads more useful information on there. Here's all you need to know.

2 min read

Unless something goes wrong with your supply or you think you’ve been overcharged, then your energy bill is likely to be the only communication you’ll ever have with your supplier, which means a lot of information needs to be crammed into it.

At first glance, it can be difficult to distinguish which parts of the bill are relevant to you - a quick energy bill check might not be enough to spot any overpayments you may be making for the energy your business is using.

To help you understand your energy bill, here is an example of a British Gas business electricity bill, along with all the key information listed below. If you’re not a British Gas customer, the actual layout of your bill might be different, but all the information will be the same.

If you’re on a rollover tariff or deemed rates you’ll be overpaying for energy. If you’re on a fixed-rate energy deal, check your energy bill to find out the date it’s due to end. If it’s about to expire, you should run a comparison and switch to a better deal.

Understanding your business energy bill isn’t always easy though, and the amount of information shown on your bills can be confusing. To help you get a better idea of what everything means, our Uswitch bills guide takes a look at all the details and individual costs that go into making up your commercial gas and electric bill.

If you’ve managed to get to grips with your energy billing and you’re ready to switch to a better deal, get in touch with our switching team on 0800 188 4930 - once you’ve found a deal that suits you, we can take care of the switch.

Now you know your way around your bill, it’s worth taking a look at what costs contribute to the final amount you’re charged - this can help you work out some ways to cut costs for cheap utility bills.

Business energy suppliers buy energy in bulk before selling it on to corporate customers. The price your supplier pays for this energy is known as the wholesale cost and this is one of the single biggest influences on your gas and electric bill cost.

This wholesale cost can be affected by a number of factors outside of the control of anyone in the energy market, such as natural disasters, political events and conflicts. Although this cost won’t actually show up on your bill, it is reflected in the unit cost you pay - that’s the rate charged for the energy you use, and the bit that’s fixed when you sign up to a fixed rate deal. If you’re not on a fixed rate tariff, then there is a good chance that your business energy bills will rise as wholesale energy prices do.

How can you reduce it? – You can protect your business from price hikes by signing up to a fixed term business energy contract, which locks in the price that you pay per unit for the duration of the contract. Your prices will still fluctuate depending upon the amount of energy you use - you’ll not have a maximum energy bill - the rates you pay won’t be affected by a change in market rates and wholesale prices.

Once the energy has been bought from the wholesale market, it needs to be transported to your business - and energy transportation isn’t cheap. Suppliers usually include this TNUoS charge with the overall price of your business energy bill, to cover any transport costs, as well as the cost of maintaining and upgrading the national grid where necessary.

TNUoS is charged at a flat rate for most businesses, but it might be higher if your business is based in a more remote location, due to the additional challenges of providing energy through the grid.

How can you reduce it? - TNUoS is a charge that is included within the total cost of all business energy bills. Short of taking the drastic step of relocating your business, there is little you can do to reduce this cost.

The Distribution Use of System cost (DUoS) is applied by the Distribution Network Operator, which are regional bodies responsible for transporting energy directly to your premises. These charges will vary depending on the type of contract you have, your maximum supply capacity and the times that you consume energy.

How can you reduce it? - This cost is affected by factors that make up your business energy contract, such as tariff type and your maximum supply capacity. If you’re looking to cut costs, you need to change your energy consumption habits, which will reduce the amount of energy that is being transported to your premises, and bring down the total cost.

The Climate Change Levy was introduced by the government to make businesses more accountable for the energy they use and the impact this energy use has on the environment. This cost is charged per unit and is included into the overall cost of your business energy bill.

How can you reduce it? – Because the CCL is charged on a per unit basis, the only way to directly reduce the amount you pay is to cut your business’s overall energy consumption. It’s also worth noting that businesses using energy from renewable sources are no longer exempt from the levy. To find out more, visit Ofgem.

As with many products, VAT is charged at a rate of 20% on your business energy bill. This is typically added onto your bill and can be found in your bill breakdown - see the diagram above.

How can you reduce it? - Unfortunately, there’s not much most businesses can do to reduce the amount of VAT they pay. But there are some exceptions - charities and other non-profit organisations are entitled to a reduction in VAT, but this must be applied for and is not offered automatically. It’s also worth noting that if your business consumes less than 33 kWh of electricity, or 145 kWh of gas per day, then you can reduce your VAT costs to as little as 5%.

There’s more than one way to pay your energy bill, you just have to work out which way is best for your business.

Direct debit is efficient for busy business owners, as money is taken directly from your account to cover your bills, and some suppliers will even offer a small discount for customers who choose this method. But, it’s important to note that a fixed amount direct debit will not take into account any variance in your bills, for example during the winter months when you’re using more energy, so you could find yourself in debt with your supplier unless you keep on top of things.

The advantages of BACS and online transfers is that it offers you the flexibility to pay exact amounts based on your energy usage. But if you don’t have the time to make the transfer every month, or if you forget to make the transfer, your account could easily fall into debt.

Some suppliers can offer their customers the option to pay for their business energy bill by cheque. Obviously this method can afford you the flexibility to only pay for the energy that you have used, but doesn’t offer you the convenience and efficiency of other methods.

And, when paying by cheque, you must allow time for it to be posted to your supplier (typically this will take 3-5 working days). Failure to post your payment in time can result in late fees.

At the bottom of your business energy bill, you will likely find a pre-populated bank giro slip that you can fill out and take to your local post office.

Ready to switch to a better business gas and electricity deal? Call us today on 0800 188 4930 and start saving.

By clicking ‘Compare Business Tariffs' you agree for us to search your current energy supplier and usage though industry held data. Enter manually.

Just enter your business address and we'll use industry data to accurately find and understand your energy usage.

One of our UK-based experts will search our supplier panel and give you a call to talk you through the results on screen.

With all the information to hand, you choose the deal that best suits your business and we'll handle the switch for you.

If you decide to switch, we’ll be paid a commission by the new supplier that is included in the prices we quote.

By clicking ‘Compare Business Tariffs' you agree for us to search your current energy supplier and usage though industry held data. Enter manually.